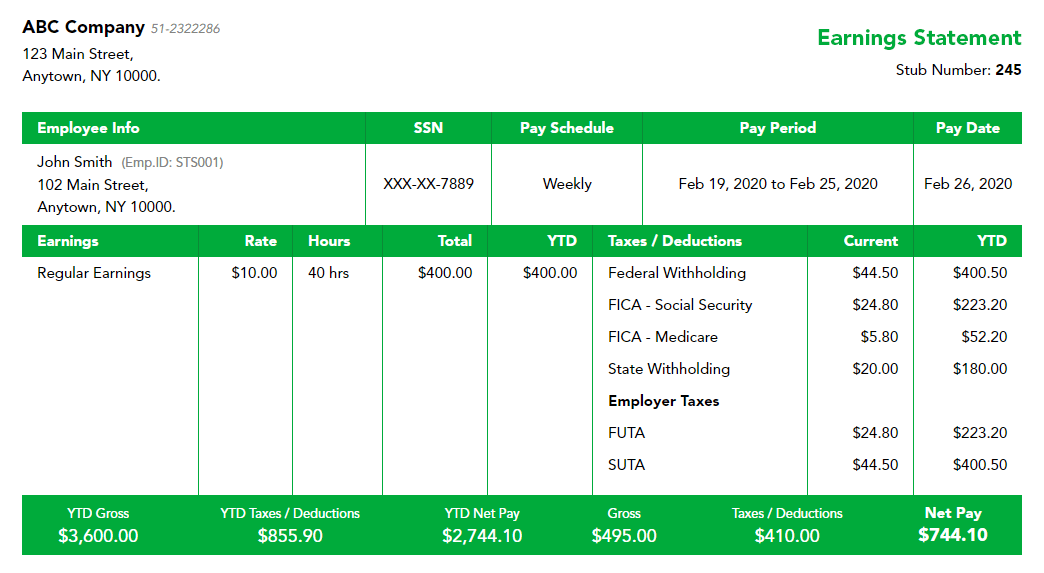

Our free paystub maker lets you make paystubs with accurate calculations of all the applicable Federal and State taxes, which includes FICA taxes, such as social security and medicare taxes.

Tired of keeping up with new tax laws? Use our pay stub maker to calculate your withholdings using both old and new 2020 Form W-4 as per your needs.

Provide only a few basic information and hit “calculate”. That’s it. Your pay stubs will be ready in seconds with accurate tax calculations and professional look.

Year to Date Calculations

Add your year to date (YTD) values to the paystubs. No need for a manual calculation. Just choose YTD from the addon and all the calculations are accurate and automatic.

Additional Earnings & Deductions

You can add and customize your paystub by adding any additional earnings like cash tips, Paycheck tips, overtime pay, holiday pay, etc. You can also add any deductions to the paystub if required.

Free Paystub Templates

Choose from any professional paystub templates to make your paystub better. The pay stub templates we provide are free of cost. And you can even change the template before downloading the paystub.

With 123PayStubMaker, enter basic information such as employee info, company info, compensation, and pay schedule. Choose the paystub template of your choice from our library and then preview. Your paystubs will be generated in seconds with accurate tax calculations.

1

Preview your paystub to ensure all the information entered is correct. You can also change the paystub template if required and continue to download. If you find any errors, you can edit and enter the right details without any restrictions.

2

If all the information in the pay stub is correct, you can continue to download the paystub instantly or send it directly to employees or contractors.Just follow the same simple steps to make paystubs for your contractors.

3Cut down the payroll cost by using our Online Paystub Maker

Using our online paystub maker, you can create your paystubs in less than 2 minutes. You have to just enter the basic info, compensation, and hours worked, and your pay stub will be generated. You can then preview the paystub and download or email it instantly.

Yes, you can change the paystub templates of your choice. We offer various professional pay stubs for you to choose. And, the best part is you can use all the paystub templates without any additional cost.

Of course, you can. Generally, self-employed people will receive their payment proof only through 1099 at the end of the year. Our paystub maker lets you create paystubs for your use like showing as proof of income while applying for a loan.

Employers can E-File Form 941 easily and securely. Just enter the required information, review the form, and transmit it directly to the IRS. The whole process takes only a few minutes. Also, you will get the filing status instantly.

123Paystubs offers the affordable price of $5.99 For Filing form 941.